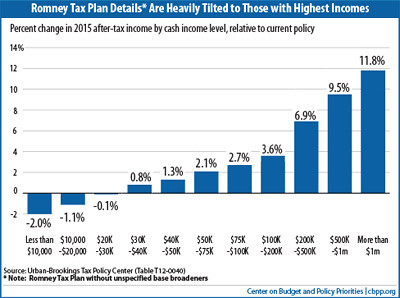

On Monday, the Associated Press gave Mitt Romney great headline. Summing up recent analyses comparing how President Obama and his challenger would fare under their own tax plans, the AP reported "Obama win could cost Romney $5M in personal taxes." Rather than declaring "Romney would cut his own tax bill in half," the AP instead seemed to suggest Governor Romney and his ilk would be the target of punitive taxes in a second Obama term. Even more glaring, Romney's plan to eliminate the estate tax was omitted altogether. And with just that one change, President Romney's heirs could theoretically pocket an $80 million windfall from the United States Treasury; a revenue hole that would have to be filled by all other American taxpayers.

The AP's Connie Cass reviewed studies by the conservative Tax Foundation and the more liberal Citizens for Tax Justice. She concluded:

Compared with what they owed in April, both men would be dinged in 2013 under Obama's proposal, along with other wealthy taxpayers. They could expect savings under Romney, depending on which tax breaks the former Massachusetts governor decides to oppose.

Among other changes to the tax code, President Obama wants to let the top tax rate for earners of $250,000 to return to its Clinton-era level of 39.6 percent and implement the Buffett Rule, guaranteeing millionaires pay a minimum 30 percent effective tax rate. (Obama would also end the "carried interest exemption" that allows Mitt Romney and other similar financiers to pay under 15 percent to Uncle Sam each year.) In contrast, Romney would not only make the Bush tax cuts permanent, but deliver a 20 percent across-the-board tax cut. Upper income taxpayers would not only see their rate slashed to 28 percent, but would benefit by the elimination of the Alternative Minimum Tax (AMT). As Cass rightly points out, "To help offset the government's losses from lower rates, Romney says he would end some tax breaks. But he hasn't said which ones, so it's impossible to calculate the effect."

But the effect of Romney's tax plan on his and Barack Obama's personal tax payments is staggering and quite easy to see (above). As CTJ revealed, Romney's total federal taxes owed to Uncle Sam (including Medicare and Social Security payroll taxes) would nose-dive by $2.8 million a year (or 49 percent). For his part, former President Obama would save $67,000 (or 29 percent) under his successor.

But left unsaid in the CTJ analysis or other media coverage of it, is that Mitt Romney's proposed tax cut windfall to his family would dwarf his own personal payday.

It's bad enough that the $250 million man Romney pays less than 15 percent of his income to Uncle Sam each year, a rate well below most middle class families. Worse still, the notorious "carried interest" exemption for private equity managers (like his son Tagg) Romney wants to preserve taxes not at the ordinary income rate of 35 percent, but at the capital gains rate now half of what it was only 15 years ago. (As it turns out, most of Mitt's millions each year come from his controversial former employer, Bain Capital.) On top of his Cayman Island investments and past Swiss bank accounts, Romney has created a $100 million trust fund for his sons ... tax free. Thanks to some (apparently legal) chicanery on the part of his former employer, Mitt has also accumulated an IRA worth a reported $100 million. The Romney camp even complained about that, worrying that recent tax code changes had "created a tax problem" for the former Massachusetts governor, asking, "Who wants to have $100 million in an IRA?"

Mitt Romney's answer to that is another question: Who wants to pay the estate tax?

That tax is currently paid by less than a quarter of one percent of American estates each year. According to the Tax Policy Center, in 2009 fewer than 2,700 family farms and businesses owed the tax to Uncle Sam. But thanks to successful Republican brinksmanship, the December 2010 tax cut compromise lowered the rate from 45 percent to 35 percent while boosting the estate tax exemption to $10 million per couple. Now, Mitt Romney wants to make sure those 40 richest estates estimated to now pay the tax each year could keep billions of dollars away from the federal government.

And among those 40 estates would be his own. With President Romney zeroing out the estate tax, those 17 grandchildren would get a golden shower when their grandparents Mitt and Ann leave the scene. On paper, their payday courtesy of all other American taxpayers could reach $84,000,000 (35 percent of $240 million).

Those winnings would represent a pretty good return on investment for the former Bain Capital CEO. Back in 2008, Romney spent $45 million of his own money in his first presidential bid, money he wrote off in hopes of securing the vice presidential slot on John McCain's Republican ticket. As Mitt's son Matt explained at the time, the Five Brothers had no problem with their diminished inheritance:

"I don't ever expect to see any of that anyways. I don't think any of us kids are counting on that money. If my dad decides to use the money he's made, then we support him."

And why not? If Mitt Romney becomes President of the United States, Matt and his four brothers will get that money—and more—back from Uncle Sam.

(This piece also appears at Perrspectives.)