Mitt Romney made twin revelations on taxes during last night's GOP debate in South Carolina. First, after previously claiming "I don't put out which tooth paste I use either," Romney suggested he might release his tax returns in April after clinching the Republican nomination. (On Tuesday, Mitt pointed to the source of his cowardice, admitting he "probably" pays only 15 percent on the millions he still earns annually from Bain Capital.) But perhaps more shocking was Romney's casual call for a top income tax rate of 25 percent. That not only contradicts his much-hyped 59-point, 162 page economic plan, but would deliver yet another massive, budget-busting windfall for the wealthy more than twice the size of the Bush tax cuts they already received.

On January 1, 2013, the top income tax rate is scheduled to return from its current 35 percent to the pre-Bush level of 39.6 percent. Romney had proposed extending the 35 percent rate for the top two percent of taxpayers (including those who like himself are among the richest 3,140 Americans). In comparison, Rick Santorum, Rick Perry and Newt Gingrich have called for slashing gilded-class tax rates to 28, 20 and 15 percent, respectively. But when Fox New host Bret Baier asked the candidates "What is the highest federal income tax any American should have to pay," Mitt apparently panicked that his payday for the upper crust was too small:

ROMNEY: I would like 25 percent, but right now it's at 35, so people better pay what is legally required. But ultimately let's get it down to as low as we possibly can, if it's 20, if it's 25 but paying more than 25 percent, I think, is taking too much out of our pockets.

BAIER: So the highest you had was 35?

ROMNEY: Well, that's what the law is right now, but 25 is where I would like to see us go.

Of course, that's not what Romney's economic plan says.

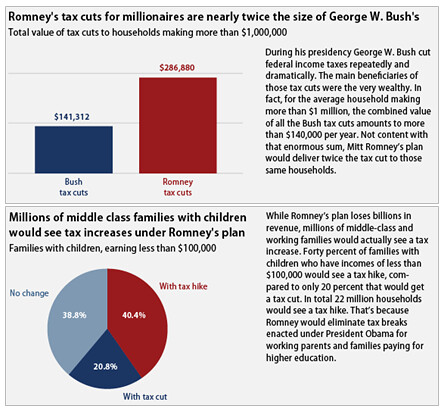

Earlier this month, McClatchy reported that "Romney tax plan would most benefit wealthy." The Center for American Progress explained just how much. While "Romney's plan also gives nearly 60 percent of its benefit to the richest 1 percent of Americans," Mitt's tax cuts for millionaires are "nearly twice the size of those from George W. Bush." And that was before Mitt Romney's spontaneous outburst Monday that he would really like a top rate of 25 and not 35 percent.

It's worth noting that the $250 Romney has also proposed eliminating the estate tax. Compared to the current 35 percent rate on estates larger than $10 million, Mitt's tax plan would give his heirs roughly $84 million courtesy of the U.S. Treasury and all other American taxpayers. Along with his plans to extend the Bush tax cuts, lower the corporate tax rate repeal some high-income tax increases from the Affordable Care Act, the impact of the national debt would be staggering. As ThinkProgress detailed in September:

Romney's tax plan includes a $6.6 TRILLION giveaway to corporations and the wealthiest Americans. Meanwhile, Romney's Medicaid cuts are even more draconian than the ones in Paul Ryan plan. Both of their plans end also end Medicare, naturally.

So much for Romney's claim that "I want to focus on where the people are hurting the most, and that's the middle class. I'm not worried about rich people. They are doing just fine."

If so, why did Mitt Romney offer the wealthy an impromptu tax cut of a third only on Monday? As he seemed to suggest to the Wall Street Journal last month, the answer is political cowardice:

What about his reform principles? Mr. Romney talks only in general terms. "Moving to a consumption-based system is something which is very attractive to me philosophically, but I've not been able to sufficiently model it out to jump on board a consumption-based tax. A flat tax, a true flat tax is also attractive to me. What I like--I mean, I like the simplification of a flat tax. I also like removing the distortion in our tax code for certain classes of investment. And the advantage of a flat tax is getting rid of some of those distortions"...

Amid such generalities, it's hard not to conclude that the candidate is trying to avoid offering any details that might become a political target. And he all but admits as much. "I happen to also recognize," he says, "that if you go out with a tax proposal which conforms to your philosophy but it hasn't been thoroughly analyzed, vetted, put through models and calculated in detail, that you're gonna get hit by the demagogues in the general election."

The demagogues Romney is afraid of are also known as the American people.

(This piece also appears at Perrspectives.)