Behind almost all of the disturbing issues raised by Mitt Romney's jaw-dropping tax returns stands one largely unchallenged conservative article of faith. Much lower tax rates for capital gains than income earned through labor, conservatives claim, spur investment, catalyze economic growth and fuel job creation. But if that Republican theology isn't true, then the United States has for decades done nothing more than deliver a massive windfall to the wealthiest Americans needing it least. Unfortunately, that's precisely what the data show. As it turns out, lower capital gains taxes increase income inequality - and not investment - in America.

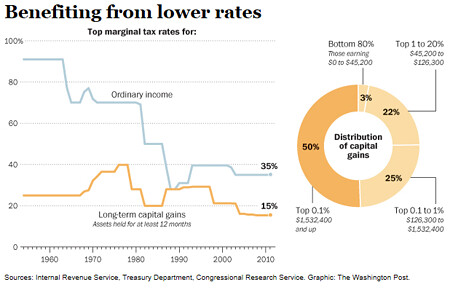

As Paul Krugman recounted two weeks ago, the historically low capital gains rate enjoyed by Mitt Romney hasn't always been 15 percent. In the not-too-distant past, it reached 39.9 percent and with the Reagan tax reform of 1986 was briefly the same as the top tax rate on income. But successive presidents of both parties lowered the capital gains rate on investment income because they believed, the Washington Post explained, "it spurs more investment in the U.S. economy, benefiting all Americans."

But as Jared Bernstein demonstrated with the chart above, there's no evidence to support that claim. Bernstein found that the business cycle, not acts of Congress, drive investment in the U.S.

Hard to see anything in the picture supporting the view that either the level or changes in cap gains taxes play a determinant role in investment decisions.

Remember, the ostensible reason for the favoritism in tax treatment here is to incentivize more investment and faster productivity growth. But that's not in the data and the reason it's not in the data is because investors aren't nearly as elastic to cap gains rates as their lobbyists say they are (more precisely, they'll carefully time their realizations to maximize their gains around rate changes, but that's not real economic activity-that's tax planning).

Reviewing other analyses, Brad Plummer of the Washington Post concurred with that assessment that low capital gains taxes don't necessarily jump-start investment in the economy:

The top tax rate on investment income has bounced up and down over the past 80 years—from as high as 39.9 percent in 1977 to just 15 percent today—yet investment just appears to grow with the cycle, seemingly unaffected...

Meanwhile, Troy Kravitz and Len Burman of the Urban Institute have shown that, over the past 50 years, there's no correlation between the top capital gains tax rate and U.S. economic growth—even if you allow for a lag of up to five years.

Billionaire Warren Buffett, the inspiration for the "Buffett Rule" advocated by President Obama and his Democratic allies, couldn't agree more. As he told The New York Times last year:

"I have worked with investors for 60 years and I have yet to see anyone -- not even when capital gains rates were 39.9 percent in 1976-77—shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off."

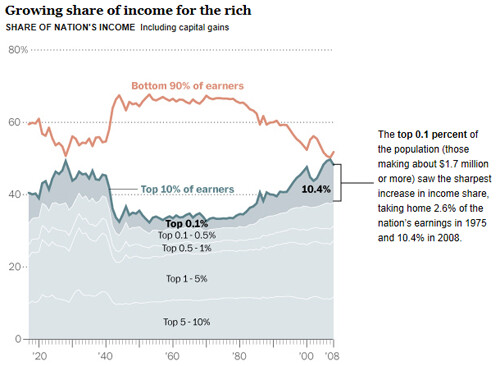

But if lower capital gains tax rates have had little impact on investment, they have had an outsized impact on income inequality in the United States.

Last fall, the nonpartisan Congressional Budget Office (CBO) confirmed that while the total federal tax burden was at its smallest level in 60 years, the income gap had grown to its largest in 80. And as the Congressional Research Service (CRS) explained in December, the rapid growth of capital gains income for the richest Americans is fueling it:

Capital gains and dividends were a larger share of total income in 2006 than in 1996 (especially for high-income taxpayers) and were more unequally distributed in 2006 than in 1996. Changes in capital gains and dividends were the largest contributor to the increase in the overall income inequality. Taxes were less progressive in 2006 than in 1996, and consequently, tax policy also contributed to the increase in income inequality between 1996 and 2006.

In September, an analysis by The Washington Post similarly concluded that "capital gains tax rates benefiting wealthy feed [the] growing gap between rich and poor." As the Post explained, for the very richest Americans the successive capital gains tax cuts from Presidents Clinton (from 28 to 20 percent) and Bush (from 20 to 15 percent) have been "better than any Christmas gift":

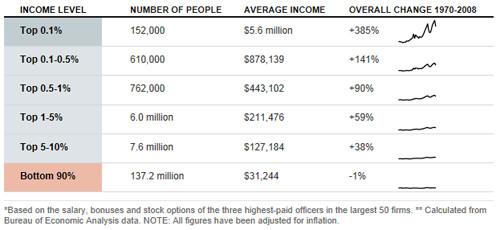

While it's true that many middle-class Americans own stocks or bonds, they tend to stash them in tax-sheltered retirement accounts, where the capital gains rate does not apply. By contrast, the richest Americans reap huge benefits. Over the past 20 years, more than 80 percent of the capital gains income realized in the United States has gone to 5 percent of the people; about half of all the capital gains have gone to the wealthiest 0.1 percent.

This convenient chart tells the tale:

As The New York Times uncovered in 2006, the 2003 Bush dividend and capital gains tax cuts offered almost nothing to taxpayers earning below $100,000 a year. Instead, those windfalls reduced taxes "on incomes of more than $10 million by an average of about $500,000." As the Times explained, "The top 2 percent of taxpayers, those making more than $200,000, received more than 70% of the increased tax savings from those cuts in investment income." It's no wonder that between 2001 and 2007—a period during which poverty was rising and average household income had fallen—the 400 richest taxpayers saw their incomes double to an average of $345 million even as their effective tax rate was virtually halved. As The Washington Post noted, "The 400 richest taxpayers in 2008 counted 60 percent of their income in the form of capital gains and 8 percent from salary and wages. The rest of the country reported 5 percent in capital gains and 72 percent in salary."

The inevitable result of plummeting tax rates overall and on capital gains in particular, as The Washington Post documented in its jaw-dropping series "Breaking Away," has been widening the chasm between the rich and everyone else in America:

Despite the destruction of their myth of low capital gains taxes, the Republican Party and its water-carriers have a new proposal. Capital gains taxes, most insist, should be eliminated altogether. While David Frum declared, "It is not an outrage that Mitt Romney pays a low capital gains tax," James Pethokoukis of the American Enterprise Institute protested that "actually, Mitt Romney's tax rate is too high":

It's real simple: If you think the biggest problem facing the United States today is income inequality, then you should be outraged that Mitt Romney's income tax rate isn't higher. But if you instead think America's biggest problem is high unemployment and a lack of economic growth, then you should be outraged that Romney is paying any income taxes at all. Really.

No, not really. It's not just that Pethokoukis is wrong on the merits. Even Mitt Romney recognizes that lowering the capital gains tax rate to zero is political suicide for Republicans. That's why Romney would only eliminate the tax on investment income up to $200,000 (which, despite his claims, does nothing for the middle class). It's also why he felt compelled during a recent GOP debate to refuse Newt Gingrich's offer to wipe out his tax bill by setting the cap gains rate to zero:

"Well, under that plan, I'd have paid no taxes in the last two years."

For once, Mitt Romney is telling the truth. Continuing to lower capital gains taxes would be great for the likes of Mitt Romney. It just wouldn't do much for the U.S. economy and the vast majority of Americans.

(This piece also appears at Perrspectives.)