Herman Cain's now ubiquitous 9-9-9 tax plan went from the ridiculous to the sublime during Tuesday night's Republican presidential debate. While House Republicans and Grover Norquist had complained that the pizza mogul's proposals constituted a tax increase, some of Cain's fellow White House hopefuls actually expressed concern that it would be lower and middle income Americans paying it.

And that is a very shocking development, indeed. After all, while he differs in his particulars, Herman Cain like Paul Ryan and George W. Bush would deliver a massive tax cut windfall for the wealthy. And like the Ryan budget voted for by 98 percent of Capitol Hill Republicans, the 9-9-9 plan would dramatically shift the tax burden to lower income Americans.

This week, the nonpartisan Tax Policy Center added its devastating analysis to the growing list of negative assessments of the Cain 9-9-9 plan. Cain's opponents seized on it to punish him throughout last night's CNN debate. "The worst part about it," Congressman Ron Paul fretted, "It's regressive. Rick Santorum explained why:

"[R]eports are now out that 84 percent of Americans would pay more taxes under his plan. That's the analysis. And it makes sense, because when -- when you don't provide a standard deduction, when you don't provide anything for low-income individuals, and you have a sales tax and an income tax and, as Michele said, a value-added tax, which is really what his corporate tax is, we're talking about major increases in taxes on people."

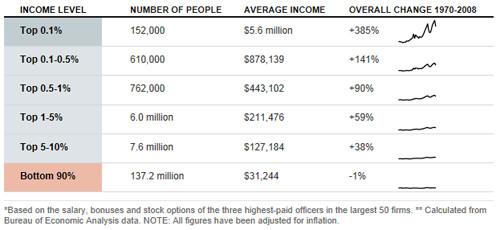

Which is exactly right. As the Washington Post's Ezra Klein showed using TPC data, while raising taxes on most Americans Cain's payday to the richest is literally off the charts. As Klein explained today, "One problem with trying to graph the 9-9-9 plan is that the tax cuts for the rich are so large that it's hard to see what the policy is doing to the poor and the middle class. That's why I posted a table [above] rather than a chart earlier."

That's what necessarily happens when you cut the top income tax rate from 35 percent to 9 percent, eliminate the Earned Income Tax Credit for working Americans, and zero out the capital gains tax. (According to the Joint Committee on Taxation, two-thirds of all capital gains are reported by those with incomes over $1 million.) As Center for American Progress Vice President for Economic Policy Michael Ettlinger put it:

"[Herman Cain's 9-9-9 plan] would be the biggest tax shift from the wealthy to the middle-class in the history of taxation, ever, anywhere."

Bigger even than the Paul Ryan budget passed by House Republicans in April. Just not by much.

As Michael Linden of the Center for American Progress explained, Ryan's scheme offered yet another cornucopia for the wealthy. (Unlike Cain's plan, the Ryan proposal omits any mention of the tax preference and loopholes it claims to close. Like most other would-be Republican tax reformers, Ryan avoids that politically dangerous work, insisting instead that "Ways and Means will have to fill in those details.") While the tax breaks to be ended remains unknown, Linden explained, "Here's what we do know. Ryan's plan would":

Maintain the Bush tax cuts, and further, cut the top individual tax rate down to 25 percent from 35 percent;

Consolidate the current six tax brackets into some, unspecified, fewer number of brackets;

Keep overall revenue levels the same;

Pay for the enormous tax cut for the top by eliminating or curtailing some, unspecified, tax expenditures.

The result is inevitably yet another huge payday for the gilded-class. While claiming to close existing loopholes in order to produce a "revenue neutral" result, Paul Ryan's brave new world would be a beautiful one for the rich and a dystopian nightmare for almost everyone else.

As the Center on Budget and Policy Priorities explained, the savings from Ryan's draconian budget cuts (three quarters of which are extracted from the poor elderly) are almost completely offset by his $4.2 trillion in tax cuts. And as Matthew Yglesias explained in April, earlier analyses of the proposals in Ryan's Roadmap reveal that working Americans would have to pick up the tab left unpaid by upper-income households:

This is an important element of Ryan's original "roadmap" plan that's never gotten the attention it deserves. But according to a Center for Tax Justice analysis (PDF), even though Ryan features large aggregate tax cuts, ninety percent of Americans would actually pay higher taxes under his plan.

In other words, it wasn't just cuts in middle class benefits in order to cut taxes on the rich. It was cuts in middle class benefits and middle class tax hikes in order to cut taxes on the rich. It'll be interesting to see if the House Republicans formally introduce such a plan and if so how many people will vote for it.

We now know the answer to Yglesias' question. 235 House Republicans and 40 GOP Senators voted for Paul Ryan's budget this past spring.

And in so doing, they were voting delivers another windfall for the wealthy courtesy of the United States Treasury. Another, that is, because the Bush tax cuts did a pretty good job of that already.

In President Bush's defense, his tax cuts of 2001 and 2003 did not actually raise taxes on working Americans. As Bush put it in February 2004, "We cut taxes, which basically meant people had more money in their pocket."

Of course, some people are more equal than others.

As the Center for American Progress noted in 2004, "for the majority of Americans, the tax cuts meant very little," adding, "By next year, for instance, 88 percent of all Americans will receive $100 or less from the Administration's latest tax cuts."

But that's just the beginning of the story. As the CAP also reported, the Bush tax cuts delivered a third of their total benefits to the wealthiest one percent of Americans. And to be sure, their payday was staggering. The Center on Budget and Policy Priorities detailed that by 2007, millionaires on average pocketed $120,000 from the Bush tax cuts of 2001 and 2003. Those in the top 1 percent stashed an extra $45,000 a year. As a result, millionaires saw their after-tax incomes rise by 7.6 percent, while the gains for the middle quintile and bottom 20% of Americans were a paltry 2.3 and 0.4 percent, respectively.

And as the New York Times uncovered in 2006, the 2003 Bush dividend and capital gains tax cuts offered almost nothing to taxpayers earning below $100,000 a year. Instead, those windfalls reduced taxes "on incomes of more than $10 million by an average of about $500,000." As the Times explained in a shocking chart: "The top 2 percent of taxpayers, those making more than $200,000, received more than 70 percent of the increased tax savings from those cuts in investment income."

It's no wonder that between 2001 and 2007, the 400 richest taxpayers saw their incomes double to an average of $345 million even as their effective tax rate was virtually halved. As the Washington Post noted, "The 400 richest taxpayers in 2008 counted 60 percent of their income in the form of capital gains and 8 percent from salary and wages. The rest of the country reported 5 percent in capital gains and 72 percent in salary."

Now, Herman Cain is calling for a redistribution of the federal tax burden so overwhelming that even Paul Ryan is getting uneasy. After initial reports that Ryan "loved" the 9-9-9 plan, his handlers were quick to back off that claim. But at least one Republican notable, supply-side snake oil salesman Arthur Laffer, is happy with Herman Cain. Then again, it was Laffer who in April 2009 provided the philosophical underpinnings for Cain's plan today:

"You really can't collect much money from upper-income people. They know how to get around taxes. So if you want to raise revenues, you've got to do it in low-level, broad-based taxes."

Or as President George W. Bush put it in arguing to make his upper-class tax cuts permanent:

"The really rich people figure out how to dodge taxes anyway."

Herman Cain just wants to make it easier for them.

UPDATE: Facing blistering criticism and simple math, Herman Cain announced changes to his 9-9-9 plan, adding a still-undefined sales tax exemption for the poor. As the Los Angeles Times reported:

Cain offered no details on how he would spare the poor from the federal sales tax. He suggested his decision to keep the exemption secret until today was a calculated strategic move.

“I wanted to wait until I got attacked on that for a while,” said Cain, whose plan was attacked Tuesday by rivals at a Las Vegas debate. “We already have a plan for that. But I wanted to see if they would come at that. They thought that it was going to be dead in the water. No.”

(An earlier version of this piece appeared at Perrspectives.)