If nothing else, Herman Cain is a man who is very sure of himself. This week, Cain once again declared God told him to run for President. But on the same day Senate Republicans continued their unprecedented obstructionism by blocking President Obama's jobs bill, Cain's own 9-9-9 plan finally started to come under scrutiny. As it turns out, Cain's simple scheme -like virtually every other recent GOP proposal - would produce mountains of debt and massively shift the tax burden to middle class Americans as the wealthy received yet another windfall from the U.S. Treasury.

Of course, you'd never know from Cain's confident prediction during Tuesday night's Bloomberg GOP presidential debate. His prescription?

Two things. Present a bold plan to grow this economy, which I have put my 9-9-9 plan on the table, and it starts with throwing out the current tax code and putting in the 9-9-9 plan.

Secondly, get serious about bringing down the national debt. The only way we're going to do that is, the first year that I'm president and I oversee a fiscal year budget, make sure that revenues equals [sic] spending. If we stop adding to the national debt, we can bring it down.

The former pizza magnate might want to check his math. Because even Herman Cain never cut a slice so big.

To "make sure that revenues equal spending," Herman Cain would have to cut roughly $1.8 trillion (or 47 percent!) from the nation's $3.8 trillion budget. Because as Bloomberg News explained, Cain's two-step plan to blow up the current income tax, end both the capital gains and estate taxes and replace them with flat 9 percent individual, corporate and sales tax rates would unleash new rivers of red ink:

Following the broad contours of Cain's plan, the U.S. would have collected almost $2 trillion in 2010, according to a Bloomberg News calculation based on data from the Commerce Department's Bureau of Economic Analysis. The U.S. actually collected almost $2.2 trillion that year, according to the White House Office of Management and Budget...

Using 2010 figures, Cain's plan would have collected $922.1 billion in revenue from the national sales tax with no exemptions, $912.7 billion at a 9 percent individual income tax with few deductions or other tax benefits, and $127.7 billion from a 9 percent tax on U.S. corporate income with no deductions.

The federal government in 2010 actually collected $898.5 billion from individuals, including levies on capital gains; $191.4 billion from the corporate income tax; $864.8 billion from Social Security and retirement taxes; $141 billion in other taxes, such as estate and gift taxes; and $66 billion in excise taxes. This doesn't include the taxes levied by states on retail sales and property.

If anything, Bloomberg's analysis understates the magnitude of the revenue problem. For example, in pre-recession 2007, total tax revenue was $2.6 trillion. The Center for American Progress estimated Cain's 9-9-9 plan would have brought in only $1.3 trillion and thus "cut federal revenue in half." It's no wonder CAP's Michael Linden concluded President Cain's would be "bigger than any deficit since WWII, including the deficits of the past three years."

But that's hardly the only poison in pizza man Herman Cain's secret sauce for Americans.

As Center for American Progress Vice President for Economic Policy Michael Ettlinger put it:

"[Herman Cain's 9-9-9 plan] would be the biggest tax shift from the wealthy to the middle-class in the history of taxation, ever, anywhere, and it would bankrupt the country."

Because Cain's 9 percent national sales tax makes no mention of a personal exemption, as economists including former Reagan Treasury official Bruce Bartlett:

This means that the 47 percent of tax filers who now pay no federal income taxes will pay 9 percent on their total income. And elimination of the payroll tax won't even help half of them because the earned income tax credit, which Mr. Cain would abolish, offsets both their income tax liability and their payroll tax payment as well.

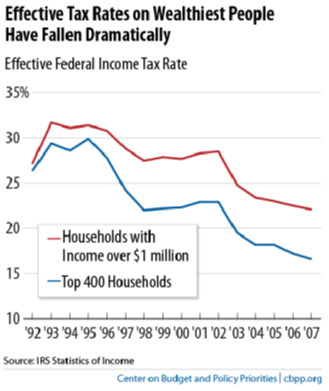

Meanwhile, the reduction of the top income tax rate from 35% to 9%, the zeroing out of the capital gains tax, and the elimination of the estate and gift taxes would mean yet another payday for the gilded-class, courtesy of working Americans. As Bartlett pointed out:

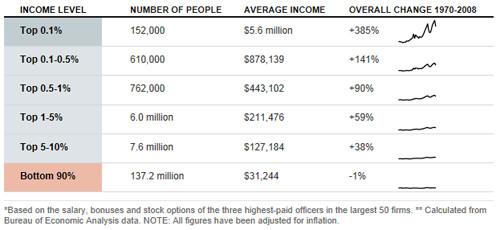

Mr. Cain would abolish all taxes on capital gains. Such taxes typically generate more than $100 billion in federal revenue annually, according to the Tax Policy Center. According to the Joint Committee on Taxation, two-thirds of all capital gains are reported by those with incomes over $1 million.

The result, as CAP's Linden concluded, would be an unprecedented downward shift of the tax burden coupled with a jaw-dropping upward redistribution of wealth in the United States:

Someone in the bottom quintile of earners -- who currently pays about 2 percent of his or her income in federal taxes -- would pay about 18 percent under Cain's plan (9 percent on every dollar they make, plus 9 percent on every dollar they spent, which would likely be close to all of them). A middle-class individual would see his or her taxes go from about 14 percent to about 18 percent. But someone in the richest one percent of Americans would see his or her tax rate fall from about 28 percent to about 11 percent.

As ABC News concluded, the "9-9-9 Plan Would Almost Double Taxes on Middle Class":

If you have a family of four with an income of just under $50,000, they would pay more under the Cain plan. Currently, they are taxed at just less than 7 percent and pay $3,400 in income tax. Under Cain’s plan, they would be taxed at 9 percent or pay $4,500.

That’s $1,100 more.

Although the family would save almost $4,000 in Social Security taxes, it would have to give up the child tax credit of $4,000. Furthermore, it would pay an additional national sales tax of 9 percent on everything purchased, including groceries and clothes, which totals about $2,000.

That means under the Cain plan that family would be almost doubling its taxes, going from $3,400 to $6,500.

Of course, if you have a sinking feeling that you've seen this movie before, that's because you have.

The Bush tax cuts, after all, siphoned off over $2 trillion from the U.S. Treasury in their first decade, and if made permanent, would drain another $4 trillion in the years to come. The Center on Budget and Policy Priorities (CBPP) found that the Bush tax cuts accounted for almost half of the mushrooming deficits during his tenure. As another CBPP analysis forecast, over the next 10 years, the Bush tax cuts if made permanent will contribute more to the U.S. budget deficit than the Obama stimulus, the TARP program, the wars in Afghanistan and Iraq, and revenue lost to the recession put together. And while those upper-class tax cuts produced the lowest federal tax burden 60 years in the highest income inequality in 80, during Bush's days in the Oval Office America's so-called "job creators" produced a meager one million jobs.

And now, Bush's would-be Republican successors would make things much, much worse. 235 House Republicans and 40 GOP Senators voted for the Ryan budget would deliver $4.2 trillion in tax cuts while raising the onus on working Americans. Mitt Romney's plan would cost the Treasury an estimated $6.5 trillion over the next 10 years even as he and his fellow One Percenters pocketed massive tax breaks. (Tim Pawlenty's $11 trillion budgetary disaster was even worse.)

But when it comes to red ink and wealth redistribution, Godfather's pizza man Herman Cain takes the cake. Which is why Cain's God apparently wanted him to run for President. As Edward Kleinbard, a former chief of staff to the congressional Joint Committee on Taxation put it:

"Either Herman Cain is the tax messiah or is proposing a system that has no correspondence to real-world tax systems."

On that second point, Americans can be certain.