David H. Jernigan, Boston University

Alcohol is still the most commonly used drug among high school students. According to the Centers for Disease Control and Prevention, every year approximately 3,500 people under 21 die because of alcohol use.

I have studied the relationship between alcohol marketing and youth drinking behavior for the past 20 years. In 2011, my colleagues and I performed what to our knowledge was the first and only survey of what specific brands of alcohol underage people drink. We asked 1,032 young drinkers about 898 brands of alcohol to learn what the underage alcohol market looks like.

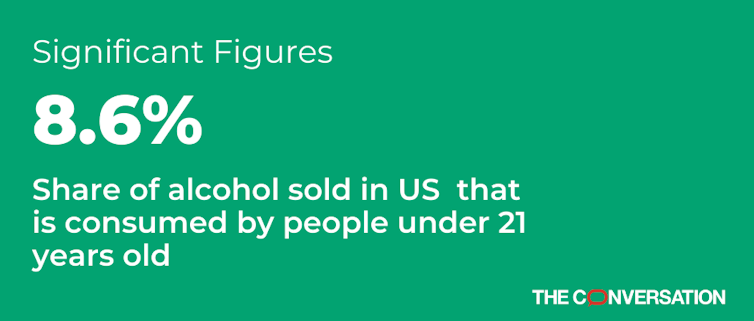

In a new paper published on June 9, 2021, my colleagues and I combined our survey data with the latest information available about alcohol consumption among adults to estimate the percent of all alcohol sold in the U.S. that was consumed by young people. Then, we were able to calculate how much money underage drinkers are spending and, importantly, which companies are making this money.

Who makes money from underage drinking?

In 2016, the most recent year for which market research and government data were available, the total value of alcoholic beverage sales in the U.S. was around US$237.1 billion. Using our model of the youth market from 2011 and our database of alcohol prices, we were able to estimate the retail sales of youth consumption for 2011 and project it to 2016. In total, we estimate that youth under 21 accounted for 8.6% of the drinks consumed and 7.4% of the dollars spent, since young people buy cheaper alcohol. This translates to $17.5 billion. While underage drinking has been steadily declining since 2002, it is still a substantial source of income for these companies.

According to our 2011 survey, the 10 most popular alcohol brands among underage drinkers were Bud Light, Budweiser, Smirnoff Malt Beverages, Smirnoff Vodkas, Coors Light, Jack Daniel’s Bourbons, Corona Extra, Mike’s, Captain Morgan Rums and Absolut Vodkas.

Three companies own most of these drinks and accounted for nearly half – 44.7% – of the alcoholic drinks consumed by young people. Anheuser-Busch InBev accounted for 21.2% of of these drinks, from which they earned $2.2 billion. MillerCoors sold 11.1% of the booze, earning $1.1 billion. Spirits- and beer-maker Diageo also sold 11.1% of the beverages youth drank – and, since liquor tends to be more expensive per drink compared to beer, earned $2 billion from underage drinking.

Revenues from underage drinking could be put to good use

Brewing industry trade association the Beer Institute says that the “U.S. beer industry has dedicated itself to preventing illegal underage drinking for more than three decades.” They go on to say that companies do their part to make sure advertising is aimed at adults, educate parents and college students about underage drinking and encourage stores to not sell alcohol to minors.

However, numerous studies have found that alcohol companies’ actions to prevent alcohol-related harms are ineffective. Our research clearly demonstrates a conflict of interest: These companies are making literally billions of dollars from the very behavior they say they want to prevent.

In response to a request from Congress, in 2003, the National Research Council and Institute of Medicine issued a major report on reducing underage drinking. They recommended that all segments of the alcohol industry that profit from underage drinking place 0.5% of total company revenues in an independent nonprofit foundation dedicated to reducing and preventing underage drinking. In 2016, this would have amounted, for example, to $78 million from Anheuser-Busch InBev. This money could do a lot to support community groups trying to implement evidence-based strategies such as reducing density of stores that sell alcohol, raising alcohol taxes and increasing enforcement around illegal sales to minors.

But no independent fund was ever created, and the alcohol companies themselves continue to control the money they contribute to preventing underage drinking, largely spending it on branded “corporate social responsibility” efforts that do more to promote their products than prevent harmful drinking.

Meanwhile, federal funding specifically dedicated to the prevention of underage drinking is minimal. The most recent president’s budget recommended a mere $10 million for grants to community coalitions working on underage drinking. On top of this, as a result of a significant alcohol tax cut passed in 2017 and made permanent in 2020, alcohol companies are contributing less to the federal budget than ever.

I believe that, because of their conflict of interest, alcohol companies cannot be trusted to spend prevention dollars effectively. The billions these companies make from underage drinking is money that the prevention field could really use. A system, independent of the industry, that would collect and allocate these unwanted revenues could be a better way to get it to local communities and help reduce and prevent underage drinking.

[Get our best science, health and technology stories. Sign up for The Conversation’s science newsletter.]

![]()

David H. Jernigan, Professor of Health Law, Policy & Management, Boston University

This article is republished from The Conversation under a Creative Commons license. Read the original article.