Conservatives say they want to "bring back" the old USA, the one that existed during those decades of the twentieth century they only seem to see through a gauzy golden haze. Whatever its problems, that country was a place where Republicans and Democrats agreed on two simple principles: That the most fortunate among us should pay their fair share, and that our government must invest in the nation and its future.

When Rick Perry says he wants to bring back "the America I where I grew up," he's talking about the era when Dwight D. Eisenhower, a Republican President, built the Federal highway system. One of the reasons Eisenhower was able to do that is that the top tax rate was much higher than it is today. While today's highest marginal today is 35 percent and capital gains are taxed at only 15 percent, the highest tax bracket was 91 percent the year Rick Perry was born.

Whenever I talk about tax brackets I'm attacked by right-wingers who say I don't understand, that high taxes discourage job creators. They'll say things like "You hippies just don't get it! If taxes are too high rich people will stop working and investing. The Job Creators will go away!"

Well, I do get it. When I was spent a student year in Great Britain the top marginal tax rate was 102%. Once a person reached a certain level of income, they had to pay more in taxes than they earned. And a few years before that, George Harrison made a compelling case against the 95 percent tax bracket on the Revolver album by singing "Taxman." (The line is "that's one for you, nineteen for me." I make that a 95 percent marginal tax rate, but you can check my math if you like.)

So I'll come right out and admit it: Taxes can be too high. But that doesn't answer the biggest question of all: What's the ideal top tax bracket? Where can we set the percentage so that it provides the most revenue for the Federal government without discouraging high earners from making more money?

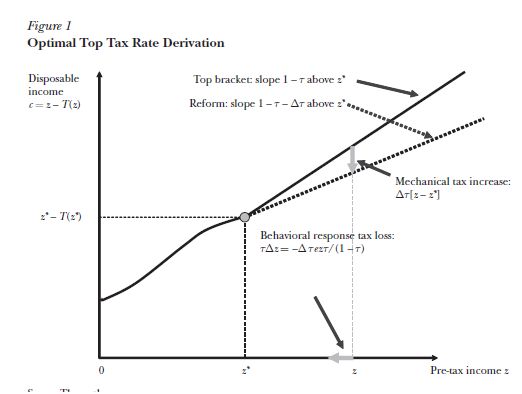

Thanks to a new and very thoughtful paper by economists Peter Diamond and Emmanuel Saez, we have the answer: 76 percent. That's right. The most effective top tax bracket in this country, the one that will provide the most revenue for the Federal government, is 76 percent. Know what that means, ladies and gentleman of Washington DC ? That's the rate that will cut the deficit the fastest.

You see where I'm going with this, don't you? All those self-proclaimed "deficit hawks" in Washington have their answer: Double the top marginal tax rate to 70%. I say 70 percent, rather than 76 percent, to show that we're reasonable people. It's true that the six-point difference would save some billionaires tens of millions of dollars. Sure, that's a lot of deficit-cutting revenue to lose, but it's important to make them feel good about themselves. A 70 percent rate will show them that we care about them enough to lose all that money. That ought to bolster their confidence.

Democrats have been framing the tax debate around the issue of letting the Bush tax cuts expire for the highest earners. That would bring the top tax rate to 39.5 percent from its current 35 percent. But why think small? Why embrace the radical, reckless, and irresponsible fiscal behavior of the Reagan era? A 70 percent tax rate will take us back to the tax levels we had during this country's boom years.

Just to be clear, this tax rate wouldn't double taxes for the wealthy. It would only apply to income about the highest cutoff point. What should that cutoff point be? Again, we're willing to be reasonable, so let's make it $1,000,000. No, wait! My manager's in a good mood. Let's make it $2,000,000, with graduated increases that begin at the $400,000 level. It wouldn't even affect everybody in the 1 percent. Agree to these terms and you can drive your new, lower-deficit Federal government off the lot right now!

And no, I'm not kidding. They'll say it's politically impossible. Really? Dwight Eisenhower's economic platform is politically impossible? Then change the range of possibility. There was a time when 15% tax rates for hedge fund managers was politically impossible, too, but they got it done. We need a little more can-do spirit around this place, people!

Conservatives will say, What about jobs? Lower taxes create jobs! There's a simple answer to that one: Since the wealthy have had today's low tax rates for ten years, where are the jobs? That theory's been conclusively disproved. Higher rates don't discourage the real job creators, the people who really create and innovate and build. 70 percent was the top tax rate when Steve Jobs and Steve Wozniak started Apple and it didn't stop them.

These findings may feel intuitively "wrong" to conservatives (although they don't feel wrong to Paul Krugman or others in a position to know). But if conservatives want to challenge these conclusions, they better be prepared to tell us why they think this is wrong:

Kevin Drum quite reasonably allows that "(government) revenue maximization isn't our only social goal." He's right, of course. Job creation's another big one, but we've covered that. So is eliminating poverty, educating our children, ensuring a secure retirement, and making sure nobody dies from a lack of food, shelter, or medical care.

People have other goals for our society, too, of course. They range from inspiring ones like freedom, liberty, and self-reliance, to unspoken and less admirable ones like the right to crush your competitors by any means necessary, the right to deceive consumers out of their hard-earned savings, or the right to indulge in gross overconsumption and meaningless excess at others' expense.

I'm inspired by freedom, liberty, and self-reliance too. But I think the young Jobs and Wozniak were free and self-reliant under a 70 percent tax rate. I don't think Dwight D. Eisenhower was a socialist oppressor of the masses. And while I'm open to an argument that says doubling the top tax rate offends core American values, I can't think of one. Eisenhower seemed pretty American to me.

So the ball's in your court, conservatives. Make your case. But until then let the new rallying cry be, Double the top tax rate! It's time for those who have benefited from our system to pull their own weight again. Or as politicians used to say but don't seem to anymore, "From whom much is given, much is expected."

They'll say I hate the rich, but I don't. I used to work with them. I admire the ones who ignore their own self interest and work for the betterment of all. Are the Rick Perrys of this country suggesting that today's rich people aren't as patriotic as they were in the fifties? You're not going to bring back the America you loved as a child with that attitude, Mister!

I don't hate the other ones either, the greed junkies or the scam artists. I care about them. I want them to live in a stable, just, and vital society with a strong and growing economy. I want them to be able to deliver products to their customers using safe and efficient highways, railroads, and bridges. I want them to have a healthy, well-paid, and well-educated workforce, now and in the generations to come.

Most of all, I care about their consciences.

Everybody in the nation's capital wants to reduce the deficit, so we know they'll be thrilled with this solution. It's like they're always saying: Why, government has to act more like a family does! When Mom and Dad sit at the kitchen table paying their bills, they have to face facts. There comes a time when they've got to look up from the papers scattered all around them and say "Honey, we need more income." Earning as much as you can is the responsible way to behave.

Raise the top rate to 70 percent? That's just doing what any smart family would do.

Good news, Washington! Fiscal sanity is on its way. The solution to your deficit problem is here, and so is your new slogan: 70 percent or bust.