"It is more blessed," Jesus said, "to give than to receive." That may be, but the billionaire backers of Mitt Romney's presidential campaign and Super PAC plan to do both. As they gather this weekend for a three-day Romney conclave in Park City, Utah and a secret Koch brothers summit in San Diego, the deep-pocketed donors and bullish bundlers ultimately hope to shower $1 billion on the Republican nominee. If the captains of industry and finance succeed, they can expect a golden shower of their own in return. After all, Romney has not merely promised to roll back environmental regulations, open federal lands to energy exploration and undo the Dodd-Frank reforms of Wall Street. Just by eliminating the estate tax, President Romney would divert tens of billions of dollars currently destined for the United States Treasury into the bank accounts of the richest families in America.

Despite record high corporate profits, historically low effective upper income tax rates and a stock market which has risen by over half since January 2009, Barack Obama is not enjoying the usual fundraising advantage of incumbency. Nowhere is this more true than on Wall Street. As Politico documented:

Mitt Romney's presidential campaign and the super PAC supporting it are outraising Obama among financial-sector donors $37.1 million to $4.8 million.

Near the front of the pack are 19 Obama donors from 2008 who are giving big to Romney. The 19 have already given $4.8 million to Romney's presidential campaign and the super PAC supporting it through the end of April, according to a POLITICO analysis of Federal Election Commission filings. Four years ago, they gave Obama $213,700. None of them has given a penny to the president's reelection campaign or the super PAC supporting it.

(As the New York Times reported this week, Robert Wolf, one of the few high-profile financiers publicly supporting President Obama, has been "muzzled" by his bosses at UBS.)

The energy industry, too, is proving a gusher for Mitt Romney and his Restore Our Future Super PAC. Hours after being named an oil adviser to the Romney campaign, Harold Hamm of Continental Resources contributed $1 million of his $11 billion net worth to Restore Our Future. Charles and David Koch have pledged $395 million for the 2012 election cycle, which combined with Karl Rove's American Crossroads and Tom Donohue's U.S. Chamber of Commerce could produce a billion-dollar tidal wave of cash to wash Barack Obama out of the White House. (As one Democratic consultant described the operation, "It's just like the Cold War. They're going to force Obama to spend himself into oblivion.")

Others among the usual suspects on the right are opening their vaults as well. Former Newt Gingrich sugar daddy and casino mogul Sheldon Adelson has said his donations could be "limitless" and will likely top $100 million. While billionaire investor and Chicago Cubs owner Joe Ricketts may have abandoned his Jeremiah Wright smear campaign, his is bankrolling other projects including the ersatz documentary based on Dinesh D'Souza's book, "The Roots of Obama's Rage." Meanwhile, Texas billionaire Harold Simmons has already delivered $18.7 million to Republican political organizations, a sum which will likely double by November.

(It is worth noting, as the New Republic and Huffington Post did recently, that many of Mitt Romney's Super PAC donors are embroiled in corporate bribery scandals. Adelson's casinos, the Walton family's Walmart operation in Mexico, Koch Brothers businesses in the Middle East and Meg Whitman's Hewlett Packard are all entangled with alleged violations of the Foreign Corrupt Practices Act.)

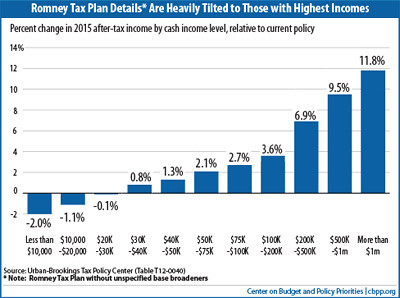

But Mitt Romney's gilded-class allies won't merely win if he slashes taxes and regulations for their businesses. They will reap a huge return on their multi-million dollar investments from the massive tax cut windfall for the wealthy would-be President Romney has in mind for them.

And it will be massive. Romney doesn't merely want to make the Bush tax cuts permanent: he wants to end the AMT and another 20 percent across the board tax cut that could reduce his own future tax bills by half. That Romney wants to maintain the notorious "carried interest exemption" that allows him to pay 15 (and not 35) percent on his millions in continuing income from Bain Capital may explains why the giants of private equity like Henry Kravis, Julian Robertson, John Paulson, Marc Rowan and Sam Zell are pouring money into his Super PAC.

But one Romney proposal above all others - the elimination of the estate tax - offers a staggering ROI for the richest families in America. In 1999, that tax was 55% on an individual's estate valued at over $675.000. Thanks to President Obama's capitulation to Congressional Republicans in December 2010, the estate tax dropped to 35 percent starting at $5 million per person. Now, Mitt Romney wants to eliminate that levy altogether, one that brings Uncle Sam billions in revenue annually.

The result will be billions back for Romney's billionaire backers. On paper, Sheldon Adelson's heirs will keep $8.75 billion (35 percent of his estimated $25 billion fortune) currently destined for the U.S. Treasury. The beneficiaries of Richard and Bill Marriott, the hotel moguls worth an estimated $3.3 billion between them, would reap an extra $1.15 billion payday. Then there's Alice and Jim Walton from the family that owns Walmart. For their combined $400,000 contribution to Romney's Super PAC, their Walmart heirs could get back 81,750 times on Alice and Jim's original investment.

As Forbes explained last year, with over $90 billion among them the six Waltons have more wealth than the bottom 30 percent of the entire American population. As Vermont Senator Bernie Sanders explained in his famous filibuster of December 2010, the elimination of the estate tax could save the Walton family alone $32.7 billion. As it turns out, President Romney's zeroing out of the estate tax would cap multi-effort for the Waltons. USA Today summed it up in 2005:

Led by Sam Walton's only daughter, Alice, the family spent $3.2 million on lobbying, conservative causes and candidates for last year's federal elections. That's more than double what it spent in the previous two elections combined, public documents show.

The Waltons have joined a coterie of wealthy families trying to save fortunes through permanent repeal of the estate tax, government watchdogs say. The election of President Bush and more conservatives to Congress gave momentum to the long-fought effort. The Waltons add more.

And so it goes. If Mitt Romney wins and gets his way in the White House, the very richest Americans will get much, much richer. And it will fall to every other taxpayer in America to replace the billions of dollars of revenue emptied from the Treasury. As Home Depot co-founder Kenneth Langone, who opened his cash spigots for Mitt Romney after Chris Christie decided to pass on a White House bid, explained it during an April lecture at Brandeis University:

"My notion about giving back is simple: I'm more of a beneficiary of my charity than the recipients of my charity. The more you give back, you think to yourself, 'Hey, maybe the world is a better place because I'm here.'"

If you have any questions about Langone's version of the view that "it's better to give than to receive," you can ask him yourself this weekend. You'll find him in Park City, Utah with Mitt Romney.

(This piece also appears at Perrspectives.)

![Trump Capitulation To Russia Complete: 'I Take [Putin] At His Word](https://crooksandliars.com/files/imagecache/thumb-100/mediaposters/2025/03/56730.jpg)