A $700 billion, 10-year windfall for the wealthiest Americans who need it least. With both parties generally supporting the continuation of middle class relief already on the books, that's the difference between Republicans and Democrats when it comes to making the expiring Bush tax cuts permanent.

But just one day after his former budget director Peter Orszag endorsed a compromise featuring a two year delay in returning upper-bracket tax rates to their Clinton-era levels, President Obama said no. Despite wavering from many in his own party, at a time of record income inequality and massive budget deficits, Obama refused to join the Republican $700 billion club Paul Krugman recently described as "eager to cut checks averaging $3 million each to the richest 120,000 people in the country."

As the New York Times reported, the President linked that stand to a package of new business tax breaks unveiled Wednesday in Cleveland. Apparently, Obama has decided that good policy is also good politics:

Mr. Obama’s opposition to allowing the high-end tax cuts to remain in place for even another year or two would be the signal many Congressional Democrats have been awaiting as they prepare for a showdown with Republicans on the issue and ends speculation that the White House might be open to an extension…

Politically, however, the president is, in effect, daring Republicans to oppose the plan, in that way proving Democrats’ contention that they will block even their own ideas to deny Mr. Obama any victories. And by proposing business tax breaks that, according to nonpartisan analyses, would do more to stimulate the economy than extending the Bush tax rates for the wealthy, Mr. Obama hopes to buttress Democrats’ opposition to extending those rates.

In response, House Minority Leader John Boehner Wednesday claimed "I'm open to the president's ideas" and proposed a two-year freeze on all tax rates. But that posturing followed his own speech in Cleveland two weeks ago in which Boehner demanded, "President Obama should work with Republicans to stop ALL of these job-killing tax hikes."

But what Boehner and his Republican allies are really advocating is yet another payday for the gilded class. To fully appreciate its magnitude for the $700 billion club, a few charts and graphs help tell the tale.

Here, then, are the Bush tax cuts in pictures:

Last month, the nonpartisan Joint Committee on Taxation examined the impact of the Democratic proposal to let the Bush tax cuts of 2001 and 2003 lapse for just the top bracket households making over $250,000 year. "Taxpayers with income of more than $1 million for 2011 would still receive on average a tax cut of about $6,300 compared with what they would have paid under rates in effect until 2001", the New York Times reported, adding, "that compares, however, with the roughly $100,000 average tax cut that households with more than $1 million in income would receive under current rates." In words and pictures, The Washington Post explained the payday for the rich if the GOP gets its way:

New data from the nonpartisan Joint Committee on Taxation show that households earning more than $1 million a year would reap nearly $31 billion in tax breaks under the GOP plan in 2011, for an average tax cut per household of about $100,000.

(Click here to see full size chart.)

The price tag for Americans' largesse for the wealthiest who need it least? $36 billion in 2011 alone, and $700 billion over the next decade.

In July, the reliably Republican Wall Street Journal offered its own pretty picture of the contending Democratic and Republican tax proposals. Despite GOP mythmaking about a "$3.8 trillion tax increase" and the "ticking tax bomb," President Obama and his Democratic allies are offering middle class Americans greater tax relief at virtually income level:

But while the next gilded class giveaway can still be stopped, the vault-fattening the past nine years is already a done deal.

In February 2004, President Bush proclaimed, "we cut taxes, which basically meant people had more money in their pocket." Of course, some people are more equal than others.

As the Center for American Progress noted at the time, "for the majority of Americans, the tax cuts meant very little," adding, "By next year, for instance, 88% of all Americans will receive $100 or less from the Administration's latest tax cuts."

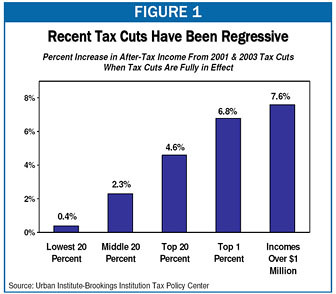

But that's just the beginning of the story. As the CAP also reported, the Bush tax cuts delivered a third of their total benefits to the wealthiest 1% of Americans. And to be sure, their payday was staggering. The Center on Budget and Policy Priorities detailed that by 2007, millionaires on average pocketed $120,000 from the Bush tax cuts of 2001 and 2003. Those in the top 1% stashed an extra $45,000 a year. As a result, millionaires saw their after-tax incomes rise by 7.6%, while the gains for the middle quintile and bottom 20% of Americans were a paltry 2.3% and 0.4%, respectively.

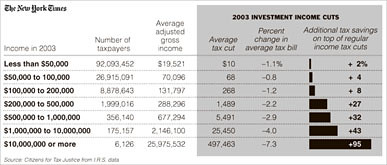

And as the New York Times uncovered in 2006, the 2003 Bush dividend and capital gains tax cuts offered almost nothing to taxpayers earning below $100,000 a year. Instead, those windfalls reduced taxes "on incomes of more than $10 million by an average of about $500,000." As the Times explained in a jaw-dropping chart: "The top 2 percent of taxpayers, those making more than $200,000, received more than 70% of the increased tax savings from those cuts in investment income."

(Click here for full size image.)

So it should come as no surprise, as Vermont Senator Bernie Sanders lamented last month, that under President Bush the 400 richest taxpayers saw their tax rates halved - and their incomes double.

To help sell these lottery-style winnings for the wealthy, Republican leaders including Mitch McConnell, John Boehner, Judd Gregg, John McCain, Tom Coburn, Carly Fiorina, Marco Rubio and an endless parade of others insisted that the Bush tax cuts did not contribute to the mushrooming national debt and that "tax cuts pay for themselves." (As recently as Sunday, McConnell asked, "Why did it all of a sudden become something that we, quote, 'pay for'?")

As it turns out, of course, the Bush tax cuts produced - and will produce - nothing but red ink as far as the eye can see.

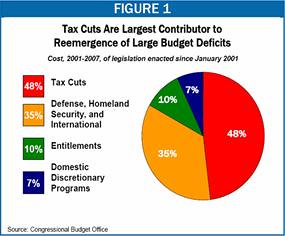

The Center on Budget and Policy Priorities demolished the mythology promoted by President Bush ("You cut taxes and the tax revenues increase") and the usual suspects on the right. CBPP found that Bush tax cuts accounted for almost half of the mushrooming deficits during his tenure:

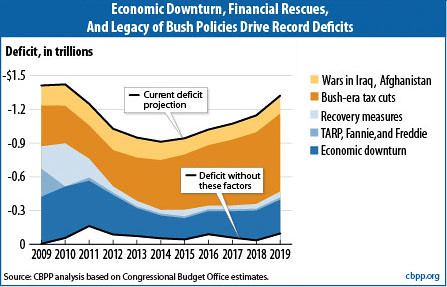

And as another recent CBPP analysis revealed, over the next 10 years, the Bush tax cuts if made permanent will contribute more to the U.S. budget deficit than the Obama stimulus, the TARP program, the wars in Afghanistan and Iraq, and revenue lost to the recession put together.

The Bush tax cuts didn't come anywhere close to paying for themselves. And making them permanent is the very worst thing the so-called deficit hawks could do to reduce the U.S. debt.

By now, you get the picture. But as the "10 Republican Lies about the Bush Tax Cuts" reveals, the GOP's strategy requires that you don't. As Paul Krugman summarized the latest Republican pitch for the rich:

And where would this $680 billion go? Nearly all of it would go to the richest 1 percent of Americans, people with incomes of more than $500,000 a year. But that's the least of it: the policy center's estimates say that the majority of the tax cuts would go to the richest one-tenth of 1 percent. Take a group of 1,000 randomly selected Americans, and pick the one with the highest income; he's going to get the majority of that group's tax break. And the average tax break for those lucky few -- the poorest members of the group have annual incomes of more than $2 million, and the average member makes more than $7 million a year -- would be $3 million over the course of the next decade.

Par for the course, Republicans are defending the members of that elite club. The $700 billion club, that is..