On Monday, Jeb Bush's Wall Street Journal op-ed raised conservative hopes that the former Florida Governor would jump in and grab the wheel of the clown car that is the 2012 GOP presidential field. But if Republicans were disappointed when Jeb squelched the nascent "Draft Jeb" movement, the American people should be relieved. After all, the American social mobility that Jeb touted in "Capitalism and the Right to Rise" is at modern lows after the decade of economic devastation presided over by his brother. And despite Jeb's mythmaking about taxes, regulations and so much else, the record shows that more Americans can climb the economic ladder when a Democrat sits in the White House.

What Upward Mobility? Whose Right to Rise?

To be sure, conservatives are praising Jeb Bush's ahistorical and data-free endorsement of the call to arms Congressman Paul Ryan issued at the Heritage Foundation:

Congressman Paul Ryan recently coined a smart phrase to describe the core concept of economic freedom: "The right to rise."

Think about it. We talk about the right to free speech, the right to bear arms, the right to assembly. The right to rise doesn't seem like something we should have to protect.

But we do. We have to make it easier for people to do the things that allow them to rise. We have to let them compete. We need to let people fight for business. We need to let people take risks. We need to let people fail. We need to let people suffer the consequences of bad decisions. And we need to let people enjoy the fruits of good decisions, even good luck.

Unfortunately for Jeb Bush and Paul Ryan, the supposed "right to rise" is now in tatters after the very years in which their ideology reigned supreme. As Fareed Zakaria pointed out in "The Downward Path of Upward Mobility":

Some believe we're still doing fine. In his address to the Heritage Foundation last month, Rep. Paul Ryan (R-Wis.) declared, "Class is not a fixed designation in this country. We are an upwardly mobile society with a lot of movement between income groups." Ryan contrasted social mobility in the United States with that in Europe, where "top-heavy welfare states have replaced the traditional aristocracies, and masses of the long-term unemployed are locked into the new lower class."

In fact, over the past decade, growing evidence shows pretty conclusively that social mobility has stalled in this country. Last week, Time magazine's cover asked, "Can You Still Move Up in America?" The answer, citing a series of academic studies was, no; not as much as you could in the past and -- most devastatingly -- not as much as you can in Europe.

As Zakaria noted, according to the OECD, upward mobility from the bottom was "was significantly lower in the United States than in most major European countries, including Germany, Sweden, the Netherlands and Denmark." And as TPM reported, an analysis by the Economic Mobility Project suggested that Jeb and George Bush could be the poster children for the limits of social mobility in the United States:

"Most studies find that, in America, about half of the advantages of having a parent with a high income are passed on to the next generation," their report concludes. "This means that one of the biggest predictors of an American child's future economic success -- the identity and characteristics of his or her parents -- is predetermined and outside that child's control. To be sure, the apple can fall far from the tree and often does in individual cases, but relative to other factors, the tree dominates the picture. These findings are more striking when put in comparative context. There is little available evidence that the United States has more relative mobility than other advanced nations. If anything, the data seem to suggest the opposite."

Jeb's Over-Taxation and Over-Regulation Myths

The data also suggest the opposite of other baseless talking points propagated by Florida's former governor. Rules and regulations, Jeb Bush whined, "are exploding in reach and complexity. They are created under a cloud of uncertainty, and years after their passage nobody really knows how they will work." And in Bush's passion play:

We either can go down the road we are on, a road where the individual is allowed to succeed only so much before being punished with ruinous taxation, where commerce ignores government action at its own peril, and where the state decides how a massive share of the economy's resources should be spent.

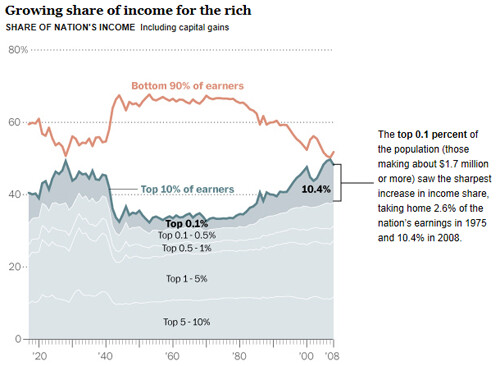

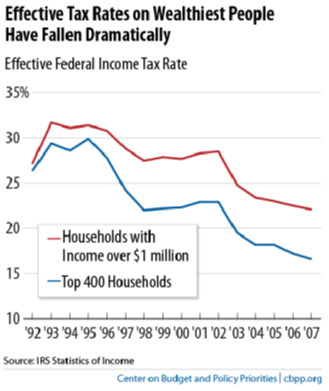

Once again, reality's well-known liberal bias belies Bush's, well, lies. As it turns out, the total federal tax burden as a percentage of the American economy is at its lowest level in 60 years. Income inequality has reached record levels not seen in 80 years. And thanks to brother George's lowering of the top income tax rate to 35 percent and the capital gains tax rate to just 15 percent, the top one percent has never had it better.

It's no wonder that between 2001 and 2007- a period during which poverty was rising and average household income had fallen - the 400 richest taxpayers saw their incomes double to an average of $345 million even as their effective tax rate was virtually halved. As the Washington Post noted, "The 400 richest taxpayers in 2008 counted 60 percent of their income in the form of capital gains and 8 percent from salary and wages. The rest of the country reported 5 percent in capital gains and 72 percent in salary."

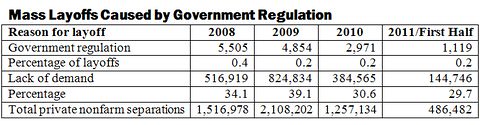

Bush's claim of an out-control regulation creating job-killing uncertainty for businesses is also sheer fantasy. As the Washington Post recently explained, "Data from the Bureau of Labor Statistics show that very few layoffs are caused principally by tougher rules." Here's what CNN learned when it asked, "Is government regulation really holding back the labor market?":

Only a small percentage of employers report regulation as a reason for laying off workers...And a CNNMoney survey of economists conducted in the second quarter delivered similar results. Only a couple of the 16 economists questioned said government regulation was the biggest drag on the labor market.

Surveys of small business owners by McClatchy, Small Business Majority and the National Federation of Independent Business (NFIB) consistently found that weak sales and sluggish customer demand - and not government regulations - were slowing hiring. And as Bloomberg explained three weeks ago:

Obama's White House has approved fewer regulations than his predecessor George W. Bush at this same point in their tenures, and the estimated costs of those rules haven't reached the annual peak set in fiscal 1992 under Bush's father, according to government data reviewed by Bloomberg News.

The Right to Rise - Brought to You by the Left

Back in October 2009, Jeb Bush warned that, "I think President Obama has used the bully pulpit as a way to attack capitalism." This week, Bush made much the same point by way of the flimsiest of straw men about "statism" versus "economic freedom":

In short, we must choose between the straight line promised by the statists and the jagged line of economic freedom. The straight line of gradual and controlled growth is what the statists promise but can never deliver. The jagged line offers no guarantees but has a powerful record of delivering the most prosperity and the most opportunity to the most people. We cannot possibly know in advance what freedom promises for 312 million individuals. But unless we are willing to explore the jagged line of freedom, we will be stuck with the straight line. And the straight line, it turns out, is a flat line.

But as the historical record shows, from economic growth and job creation to stock market performance and just about every other indicator of the health of American capitalism, the modern U.S. economy has almost always done better under Democratic presidents. Despite GOP mythology to the contrary, America generally gained more jobs and grew faster when taxes were higher (even much higher) and income inequality lower. And while the U.S. recovery from the Bush recession remains painfully slow, most economists - including the nonpartisan CBO and some of John McCain's own 2008 advisers - believe President Obama saved it from the abyss.

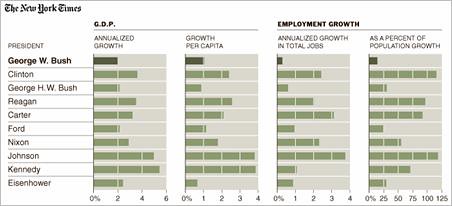

To be sure, George W. Bush provided the perfect bookend to era of modern Republican economic management ushered by Herbert Hoover. The verdict on President Bush's reign of ruin was pronounced even before Barack Obama took the oath of office. Just days after the Washington Post documented that George W. Bush presided over the worst eight-year economic performance in the modern American presidency, the New York Times on January 24, 2009 featured an analysis ("Economic Setbacks That Define the Bush Years") comparing presidential performance going back to Eisenhower. As the Times showed, George W. Bush, the first MBA president, was a historic failure when it came to expanding GDP, producing jobs and fueling stock market growth.

On January 9, 2009, the Republican-friendly Wall Street Journal summed it up with an article titled simply, "Bush on Jobs: the Worst Track Record on Record." (The Journal's interactive table quantifies his staggering failure relative to every post-World War II president.) The meager one million jobs created under President Bush didn't merely pale in comparison to the 23 million produced during Bill Clinton's tenure. In September 2009, the Congressional Joint Economic Committee charted Bush's job creation disaster, the worst since Hoover:

That dismal performance prompted David Leonhardt of the New York Times to ask last fall, "Why should we believe that extending the Bush tax cuts will provide a big lift to growth?" His answer was unambiguous:

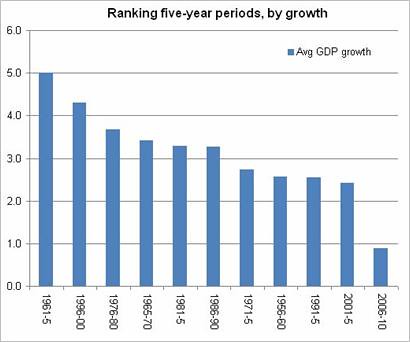

Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7...

Is there good evidence the tax cuts persuaded more people to join the work force (because they would be able to keep more of their income)? Not really. The labor-force participation rate fell in the years after 2001 and has never again approached its record in the year 2000.

Is there evidence that the tax cuts led to a lot of entrepreneurship and innovation? Again, no. The rate at which start-up businesses created jobs fell during the past decade.

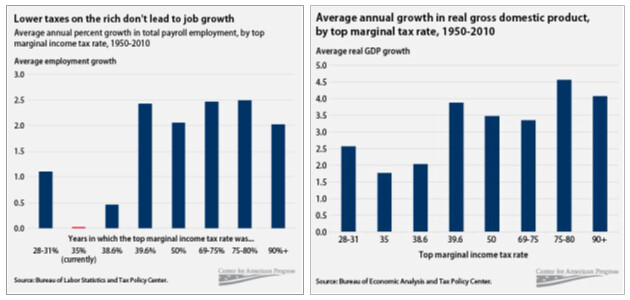

The data are clear: lower taxes for America's so called job-creators don't mean either faster economic growth or more jobs for Americans.

It's no wonder Leonhardt followed his first question with another. "I mean this as a serious question, not a rhetorical one," he asked, "Given this history, why should we believe that the Bush tax cuts were pro-growth?" Or as Mark Shields asked and answered in April:

"Do tax cuts help 'job creators' or 'robber barons'?"

But as the Washington Post and the New York Times suggested, Bush's dismal performance was hardly the exception to the rule. In general, the American economy simply does better when a Democrat sits in the White House. Apparently, America's job creators can create a lot more jobs when their taxes are higher - even much higher - than they are today.

For the investor class so fond of perpetuating the myth of Republicans' superior economic stewardship, the collapse of the stock marketing during the Bush recession must be particularly galling. The Standard & Poor's 500 spiraled down at annual rate of 5.6% during Bush's time in the Oval Office, a disaster even worse than Richard Nixon's abysmal 4.0% yearly decline. (Only Herbert Hoover's cataclysmic 31% plunge makes Bush look good in comparison.)

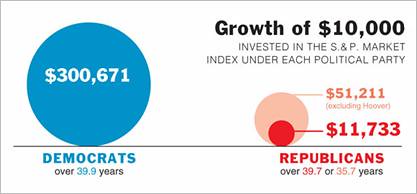

As it turns out, as the New York Times also showed in October 2008, the Democratic Party "has been better for American pocketbooks and capitalism as a whole." To make its case, the New York Times asked readers to imagine having put their money where its mouth is. Contrary to Republican mythology, Americans fare better - much, much better - under Democratic administrations:

As of Friday, a $10,000 investment in the S.& P. stock market index would have grown to $11,733 if invested under Republican presidents only, although that would be $51,211 if we exclude Herbert Hoover's presidency during the Great Depression. Invested under Democratic presidents only, $10,000 would have grown to $300,671 at a compound rate of 8.9 percent over nearly 40 years.

(For the eye-popping chart of the S&P's performance under each of the presidents from Hoover through Bush 43, visit here.)

As the broader record shows, the best path to prosperity is to elect Democratic presidents.

(There's no shortage of studies to show that stock market returns are higher under Democratic leadership. As Slate in 2002 and the New York Times in 2003 found, "It's not even close. The stock market does far better under Democrats." Barack Obama has been no exception.)

In a nutshell, enabling the American Dream by empowering citizens with education, civil rights, basic health care, retirement security and a social safety net has been and remains the liberal project. To the extent there is an American "right to rise," it is because the left made it possible. As for Jeb Bush and his allies, they would do well to remember the words of Harry Truman, as true today as when he first uttered them generations ago:

"If you want to live like a Republican, vote Democratic."

(This piece also appears at Perrspectives.)