Among the predictable differences between the Democratic and Republican members of the so-called debt super committee is this: Democrats propose to increase revenue by raising taxes, while Republicans want to increase revenue by cutting taxes. You read that right. After Ronald Reagan tripled the national debt and George W. Bush doubled it again thanks in large part to supply-side tax cuts that gutted the U.S. Treasury, Congressional Republicans are once again peddling the GOP's biggest fraud that "you cut taxes and the tax revenues increase."

On Wednesday, super committee Democrats offered an initial proposal delivering an estimated $3 trillion in debt reduction by 2021. But since roughly half that figure would come from new tax revenue largely produced by modest rate hikes on the wealthiest Americans, Republicans instantly dismissed the Democratic plan. House Speaker John Boehner said it wasn't "serious." As one GOP aide put it, "It is ridiculous, nothing more than political posturing."

Instead, Republican debt panel members put forward their own plan the next day. And as the Washington Post explained, the GOP proposal went from the ridiculous to the sublime:

Republicans, instead, have offered more than $2 trillion in savings over 10 years, highlighted by nearly $700 billion in spending reductions to Medicare and Medicaid. According to lawmakers and aides familiar with the GOP proposal, it includes an offer of more than $600 billion in savings from new tax revenue. But the two sides are in deep dispute because Republicans want to count these increased receipts based on the expectation of surging economic growth -- a standard that neutral budget observers have declined to use in the past.

If that "magic asterisk" sounds familiar, it should. The tried and untrue talking point that tax cuts spur economic growth so rapid that revenues exceed what they otherwise would have been was the formula for the mountains of debt produced by Reagan and Bush.

As Reagan's OMB chief David Stockman learned the hard way, Arthur Laffer's supply-side snake oil may have been Republican orthodoxy ever since Jude Wanniski sketched Laffer's curve on a cocktail napkin, but it also happened to be catastrophically wrong.

As most analysts predicted at the time, Reagan's massive $749 billion supply-side tax cuts in 1981 quickly produced even more massive annual budget deficits. Combined with his rapid increase in defense spending, Reagan delivered not the balanced budgets he promised, but record-setting debt. Even his OMB alchemist Stockman could not obscure the disaster with his famous "rosy scenarios" and "future savings to be identified."

Forced to raise taxes eleven times to avert financial catastrophe, the Gipper nonetheless presided over a tripling of the American national debt to nearly $3 trillion. By the time he left office in 1989, Ronald Reagan more than equaled the entire debt burden produced by the previous 200 years of American history. It's no wonder that, three decades after he concluded "the supply-siders have gone too far," Stockman lamented last year:

"[The] debt explosion has resulted not from big spending by the Democrats, but instead the Republican Party's embrace, about three decades ago, of the insidious doctrine that deficits don't matter if they result from tax cuts."

And that magical thinking - that "tax cuts pay for themselves" and "tax cuts raise revenue" and "tax cuts don't need to be offset" - dominates what passes for thinking by the Republicans' born-again deficit hawks.

For example, take GOP debt super committee panelist and second ranking Senate Republican Jon Kyl.

In June, the second ranking Senate Republican joined House Majority Leader Eric Cantor in walking out of debt reduction talks led by Vice President Biden because of their refusal to accept even a dime of new tax revenue. As Jon Kyl explained last summer, tax cuts don't increase the national debt:

"You do need to offset the cost of increased spending, and that's what Republicans object to. But you should never have to offset cost of a deliberate decision to reduce tax rates on Americans."

Kyl's was just the latest repackaging of President Bush's long ago debunked claim that "you cut taxes and the tax revenues increase." Texas Senator Kay Bailey Hutchison parroted that line, "Every major tax cut we've had in history has created more revenue." Then House Minority Leader John Boehner agreed, insisting last June that the Bush tax cuts had nothing to do with the depleted U.S. Treasury, "It's not the marginal tax rates ... that's not what led to the budget deficit. The revenue problem we have today is a result of what happened in the economic collapse some 18 months ago." For his part, Senate Minority Leader Mitch McConnell rushed to defend Kyl's fuzzy math:

"There's no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject."

That view may be Republican orthodoxy, but it also happens to be utterly wrong.

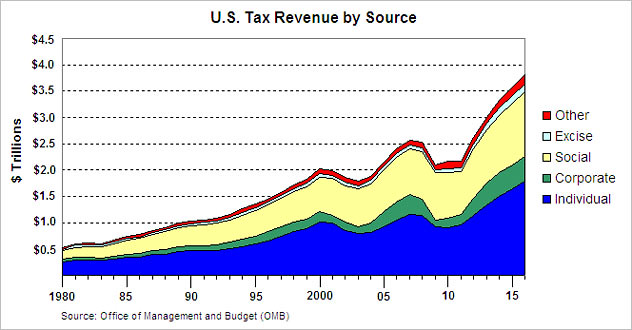

It's not just that Uncle Sam's cash flow from individual income taxes did not return to its pre-Bush tax cut level until 2006:

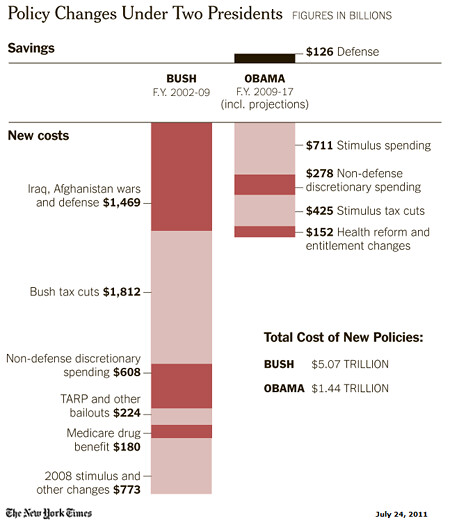

As the Washington Post summed up the CBO's conclusions regarding the causes of the nation's mounting debt earlier this year, "The biggest culprit, by far, has been an erosion of tax revenue triggered largely by two recessions and multiple rounds of tax cuts." A recent analysis by the New York Times echoed that finding:

With President Obama and Republican leaders calling for cutting the budget by trillions over the next 10 years, it is worth asking how we got here -- from healthy surpluses at the end of the Clinton era, and the promise of future surpluses, to nine straight years of deficits, including the $1.3 trillion shortfall in 2010. The answer is largely the Bush-era tax cuts, war spending in Iraq and Afghanistan, and recessions.

But as Ezra Klein explained in the Washington Post, the revealing Times chart doesn't tell the full story of the impact of Bush-era policies on future debt facing Barack Obama:

What's also important, but not evident, on this chart is that Obama's major expenses were temporary -- the stimulus is over now -- while Bush's were, effectively, recurring. The Bush tax cuts didn't just lower revenue for 10 years. It's clear now that they lowered it indefinitely, which means this chart is understating their true cost. Similarly, the Medicare drug benefit is costing money on perpetuity, not just for two or three years. And Boehner, Ryan and others voted for these laws and, in some cases, helped to craft and pass them.

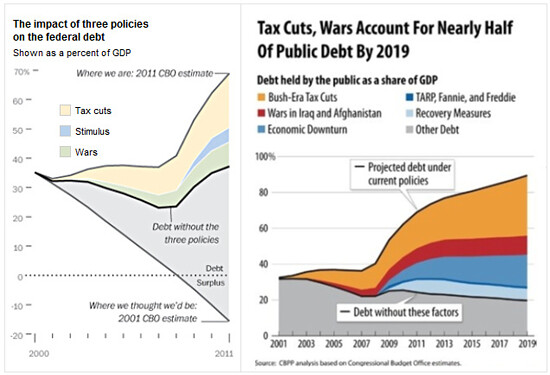

These two graphs from the Washington Post and the Center on Budget and Policy Priorities make that point crystal clear. Analyses by CBPP showed that the Bush tax cuts accounted for half of the deficits during his tenure, and if made permanent, over the next decade would cost the U.S. Treasury more than Iraq, Afghanistan, the recession, TARP and the stimulus - combined.

Utah Senator Orrin Hatch was telling the truth when he described Republican fiscal mismanagement during the Bush years by acknowledging, "It was standard practice not to pay for things." So, too, did Vice President Dick Cheney when he famously declared, "Reagan proved deficits don't matter."

Not, that is, if a Republican is in the White House.

In their defense, Republicans are absolutely right that tax cuts lead to economic growth. (Of course, this is a definitional truth, as GDP equals consumption plus investment plus government plus net exports minus taxes.) But the record of the past thirty years is clear. Far from producing federal tax revenue greater than what higher rates would have generated, the Republicans' tax-cutting binge has only created oceans of red ink. All of which can mean only one thing.

John Boehner's "serious" Republicans will empty the United States Treasury just to give another tax cut windfall to the wealthy.

(This piece also appears at ** Perrspectives.)