The new House Republican budget unveiled by Congressman Paul Ryan last week does many things. Ryan’s so-called “Path to Prosperity” would deliver yet another massive tax cut windfall for the wealthy and pay for it by gutting the social safety net he pretends to protect. “Ryancare” would end Medicare as we know it with a premium support gambit that would dramatically shift health care costs to America's seniors. While increasing defense spending, the House Budget Chairman would repeal the Affordable Care, slash Medicaid by a third and leave an estimated 48 million more people without health insurance. And despite his lofty pledges to eliminate many tax loopholes and deductions to fund his gilded-class giveaway, Paul Ryan doesn’t have the courage to say which ones.

Which is why the Ryan plan does not do the biggest thing it claims to achieve. Rather than reducing the U.S. national debt, Paul Ryan’s House GOP budget would bleed trillions in more red ink from the U.S. Treasury.

Nevertheless, as Heather of Crooks and Liars’ Video Café pointed out, Republicans and their water carriers at Fox News continue to pretend otherwise. On Sunday morning, Mike Huckabee aided GOP Rep. Tom Price (R-GA) in perpetuating that myth:

HUCKABEE: Well, one of the things that your committee has put forth this week Congressman is a chart. It's pretty startling and it shows that if we continue on the current trajectory, here's what happens to really the debt as a share of the economy verses Congressman Ryan and your committee's plan. You see in the green, that's the path that Congressman Ryan has that gets us back to a balanced budget.

Frankly, it takes a while, to the year 2040, but describe what happens if we don't do something pretty bold.

PRICE: Well, you see the gray on that chart on the left side of the chart is the amount of debt, the percentage of debt that relates to the gross domestic product that we've had in this country since 1940 until now. The red is not made up. That is the President's budget. That's the current plan that the President has in order to get this economy rolling...That's just going to kill us as a country. So what we believe again is there are responsible, positive ways to solve this. The green on the chart is that responsible way, which gets us on a path to balance and then allows us over period of time, yes a significant period of time, but allows us to pay off the $15 trillion plus in debt that this country has.

As it turns out, not so much. There’s nothing “responsible” or “positive” about it.

That may seem like a surprising result, given Rep. Ryan's declaration that his mission is to "prevent an explosion of debt from crippling our nation and robbing our children of their future." But even with his draconian budget blueprint that cuts Medicaid by a third, ends Medicare as we know it, adds 48 million people to the ranks of the uninsured and by 2050 would result in ending all non-defense discretionary spending, over the next decade Ryan would unleash torrents of red ink from the U.S. Treasury. Ezra Klein explained how Paul Ryan came up $6.2 trillion short:

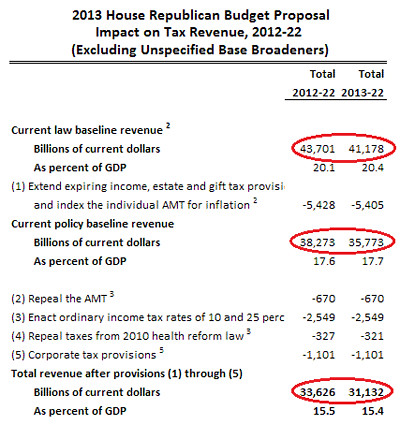

The Tax Policy Center looked into the revenue loss associated with House Budget Chairman Paul Ryan's plan to cut the tax code down to two rates of 10 percent and 25 percent. They estimate the changes would raise $31.1 trillion over 10 years, or 15.4 percent of GDP. That's $10 trillion less than the tax code would raise if the Bush tax cuts were allowed to expire, and $4.6 trillion less than it would raise if all of the Bush tax cuts were extended.

The Republican congressman says he'll "broaden the tax base to maintain revenue...consistent with historical norms of 18 to 19 percent." So let's say Ryan needs to find close-enough deductions and loopholes to hit 18.5 percent of GDP. That means he'd need to close about $6.2 trillion in tax deductions and loopholes over 10 years.

(See chart after the break.)

And so far, Ryan hasn't had the courage to name a single deduction he would end or loophole he would close. As Matthew Yglesias pointed out, in Ryan's 13-page description of his tax reform vision, those politically tough choice are completely missing:

Thirteen pages dedicated to explaining his vision for revenue-neutral tax reform. And even so he manages to not name a single tax deduction that he's planning to eliminate. Home mortgage interest deduction? I dunno. Electric vehicle tax credit? I dunno. Deductibility of state and local income taxes? I dunno.

Rolling out his plan on Tuesday, Ryan admitted as much. The responsibility for making the numbers work and taking the heat for ending popular deductions would go to House Ways and Means Committee, which Ryan claimed would "show how they would go about doing this." It's no wonder Greg Sargent said Ryan's "Path to Prosperity" plan simply "is not serious" while the New York Times called it "careless."

And one other thing. Over the next 10 years, the Ryan House budget would add substantially more to the national debt than President Obama's proposed 2013 plan.

As the Center for American Progress explained, the Congressional Budget Office (CBO) assessment of the Ryan budget "did not test Rep. Ryan's claims about how his policies would actually affect spending or revenue," but "merely showed what would happen to the debt if his claims were true." In a nutshell, they are not:

But the House budget's entire claim to deficit reduction is built on the foundation of those fantasy revenue levels. Without them, the debt goes up, not down. In fact, with all the House budget's tax cuts properly accounted for, revenue would average just 15.3 percent of GDP from 2013 through 2022, not 18.3 percent. The result: deficits would never drop below 4.4 percent of GDP, and would rise to more than 5 percent of GDP by 2022.

The national debt, measured as a share of GDP, would never decline, surpassing 80 percent by 2014, and 90 percent by 2022. By comparison, President Barack Obama's budget proposal, released in February, would stabilize the debt by 2015, and bring it down to 76 percent by 2022.

If this all sounds familiar, it should. Because just last month, Mitt Romney also rolled out a new economic plan, one which similarly hemorrhages red ink in part because it refuses to name a single deduction it would eliminate. After Romney insisted his plan “can't be scored, because those kinds of details will have to be worked out with Congress,” Ezra Klein pointed out the obvious:

"Let's be clear on this: A tax plan that can't be scored because it doesn't include sufficient details is not a plan. It's a gesture towards a plan, or a statement of intended direction, or perhaps an unusually wonky daydream. But it's not a plan."

Writing in the New York Times, conservative columnist Ross Douthat admitted as much, pleading with his readers to focus on the Ryan budget’s “structure, not numbers.” Meanwhile, his Times’ colleague Paul Krugman wondered why “Very Serious People” are once again suffering from a case of Paul Ryan’s “flim-flam fever”:

“Are they willing to concede, at long last, that he’s a clown?”

(Hat tip to Heather for capturing the preposterous Price-Huckabee exchange.)