"The chief consequence of the conservatives' unrelenting faith in the badness of government," Thomas Franks wrote three years ago in The Wrecking Crew, "is bad government." But would happen if virtually every article of that faith were wrong or, much worse, a blatant lie? Then you'd have something that looks very much like the crisis over the soon-to-be breached U.S. debt ceiling. After all, despite the dire warnings of impending doom from economists, the Federal Reserve, Wall Street ratings agencies, GOP-friendly business groups and even some of their leaders, many Republicans would sooner see the United States default and its recovery destroyed than follow the dictates of either national interest or reason. And it's all because the Republican prime directive - political power at any cost - trumps the truth.

Arizona's Jon Kyl, the second-ranking Senate Republican, gave the game away in April when his office declared his slander of Planned Parenthood was "not intended to be a factual statement." So it is for just about every GOP talking point. Tax cuts don't "pay for themselves." The GOP job creators didn't create jobs after the Bush tax cuts, though they did when their taxes were higher. There are neither "death panels" nor a "government takeover of health care" in the Affordable Care Act which, despite Republican myth-making, actually reduces the national debt over the next decade. Barack Obama isn't a Muslim, but he was born in the United States. Public employees are not overpaid and vote fraud does not threaten American democracy. Global warming isn't "the greatest hoax ever perpetrated on the American people." And we did not go to war in Iraq "because we were attacked."

Despicable and dangerous as these frauds are, they didn't threaten to destroy the American economy in a matter of days and with it, the global financial system.

It's not as if the Republican "default deniers" and "debt kamikazes" weren't warned.

On the same day last week, the U.S. Chamber of Commerce, Federal Reserve Chairman Ben Bernanke and Wall Street rating agencies joined the ever-louder chorus of voices warning Republicans that failure to raise the U.S. debt ceiling would result in "calamity." Those pleas followed a new analysis by the Bipartisan Policy Center concluded that failure to boost the debt ceiling by the August drop-dead window would force the U.S. Treasury to immediately slash spending by 44%. As The Hill reported, "On an annualized basis, the cut in spending alone is a 10 percent cut in GDP, BPC scholar Jay Powell told reporters." The IMF similarly cautioned that "the debt ceiling should be raised as soon as possible to avoid damage to the economy and world financial markets." 235 economists - including six Nobel Prize winners - signed an open letter to Congressional leaders urging them to raise the ceiling, and to do so "without attaching drastic and potentially dangerous reductions in federal spending." Failure to do so, they warned, "could push the United States back into recession." So it came as no surprise when Treasury Secretary Tim Geithner declared on Thursday, "We're running out of time" to avoid what Ezra Klein deemed the "catastrophic calculations" of default.

But Republicans don't need to take Geithner's word for it. They can heed the words of their party bosses.

In their few moments of candor, GOP leaders expressed agreement with Tim Geithner's assessment that default by the U.S. "would have a catastrophic economic impact that would be felt by every American." The specter of a global financial cataclysm has been described as resulting in "severe harm" (McCain economic adviser Mark Zandi), "financial collapse and calamity throughout the world" (Senator Lindsey Graham) and "you can't not raise the debt ceiling" (House Budget Committee Chairman Paul Ryan). In January, even Speaker John Boehner acknowledged as much:

"That would be a financial disaster, not only for our country but for the worldwide economy. Remember, the American people on Election Day said, 'we want to cut spending and we want to create jobs.' And you can't create jobs if you default on the federal debt."

Nevertheless, eight month after he warned his new GOP House majority that "we're going to have to deal with it as adults" and three months after he told a Tea Party gathering that "we're going to have to raise it again in the future," Speaker Boehner this week acknowledged that at least 60 GOP Congressmen "won't vote to raise the debt ceiling under any circumstances."

Boehner's head count doesn't begin to do justice to the Republican fiscal recklessness bordering on dementia.

For months, Republican presidential candidates Michele Bachmann and Tim Pawlenty led the default denier chorus. While Mitt Romney joined Rick Santorum, Newt Gingrich and Ron Paul in supporting the "Cut, Cap and Balance" Pledge which demands a balanced budget amendment and draconian spending cuts as conditions of raising the debt ceiling. This week, the House and Senate will vote on their respective versions of the Cut, Cap and Balance Act, which among other things would require supermajorities to raise taxes or breach a federal spending cap targeted at 18% of U.S. gross domestic product.

As it turns out, outlays by the federal government haven't been as low as 18% of GDP since 1966. (That's why the Simpson-Bowles Commission created by President Obama and opposed by Senate Republicans set a 21% target.) As it turns out, the 98% of Republicans in Congress voted for Paul Ryan's budget plan would fail their own Cut, Cap and Balance test. As Ezra Klein explained in April:

House Republicans voted to make the Ryan budget law. But the Ryan budget includes $6 trillion in new debt over the next 10 years, which means that to become law, the Ryan budget would require a substantial increase in the debt ceiling. But before the Republicans agree to increase the debt ceiling so that the budget they passed can become law, Republicans are demanding the passage of either a balanced budget amendment that would make the Ryan budget unconstitutional or a spending cap that the Ryan budget would, in certain years (and if you're using more realistic numbers, in all years), exceed.

Nevertheless, House Republicans, pressured by Tea Party zealots, have been digging in their heels. This week, Congressmen Louie Gohmert (R-TX) and Steve King (R-IA) joined Bachmann in calling the Obama administration's warnings about the August 2 deadline lies. (Not to be outdone, Sarah Palin, who previously blasted "Timothy Geithner's false statements to the American people," tweeted "Obama lies, economy dies.") Georgia Rep. Paul Broun called for the debt ceiling to be lowered to $13 trillion, would necessitate immediately cutting roughly three-fourths of all federal spending. And while Arkansas Rep. Eric "Rick" Crawford announced that a default "wouldn't work for just a few days, that would work for a few years," his freshman colleague Mo Brooks (R-AL) insisted no debt ceiling increase, no problem. As the Washington Post reported:

"There should be no default on August 2," Brooks said. "In fact, our credit rating should be improved by not raising the debt ceiling."

That stands in contrast to a warning from Moody's. The rating agency said Wednesday that it might downgrade the U.S. government's top-notch credit rating, "given the rising possibility that the statutory debt limit will not be raised on a timely basis, leading to a default."

It's now wonder conservative columnist David Brooks fretted that the GOP is no longer "a normal party." Or as former Bush Treasury Secretary Paul O'Neill put it:

"The people who are threatening not to pass the debt ceiling are our version of al Qaeda terrorists. Really. They're really putting our whole society at risk by threatening to round up 50 percent of the members of the Congress, who are loony, who would put our credit at risk."

Mercifully for the future of the U.S. economy, some of its willing executioners are starting to understand that their debt ceiling hostage taking could mean national suicide. As the Los Angeles Times revealed, the House leadership deployed Paul Ryan to explain the consequences of a Republican failure to raise the U.S. borrowing limit.

At a closed-door meeting Friday morning, GOP leaders turned to their most trusted budget expert, Rep. Paul D. Ryan of Wisconsin, to explain to rank-and-file members what many others have come to understand: A fiscal meltdown could occur if Congress fails to raise the debt ceiling.

House Speaker John A. Boehner of Ohio underscored the point to dispel the notion that failure to allow more borrowing is an option.

"He said if we pass Aug. 2, it would be like 'Star Wars,'" said Rep. Scott DesJarlais, a freshman from Tennessee. "I don't think the people who are railing against raising the debt ceiling fully understand that"...

Freshman Rep. Steve Womack (R-Ark.) said the presentation about skyrocketing interest rates that could result from downgraded bond ratings was "sobering."

"It illustrates to us that doing nothing is unacceptable," he said. "I think the conference understands this is a defining moment for us. It's time to put the next election aside."

Sadly, that small nod to reality doesn't mean the return of truth to the Republican debt ceiling hostage crisis. As Rep. Joe Walsh (R-IL) put it in a shocking video. "Quit lying," Walsh told President Obama, adding:

"But have you no shame, sir? In three short years, you've bankrupted this country and destroyed job creation."

Sadly for Walsh, the shame is all his.

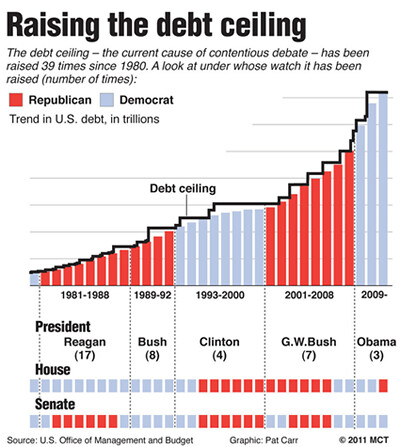

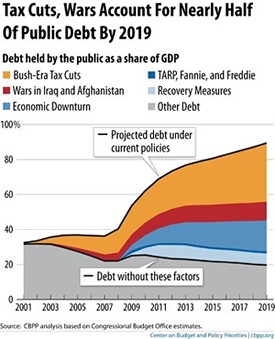

Leave aside for the moment that Ronald Reagan tripled the national debt and George W. Bush nearly doubled it. Forget also that the Bush tax cuts were the biggest driver of debt over the past decade, and if made permanent, would be continue to be so over the next. Pay no attention to the federal tax burden now at its lowest level in 60 years or income inequality at its highest level in 80 years after a decade of plummeting rates on America's wealthiest taxpayers, Ignore for now that Republican majorities voted seven times to raise the debt ceiling under President Bush and the current GOP leadership team voted a combined 19 times to bump the debt limit $4 trillion during his tenure. Look away from the two unfunded wars in Afghanistan and Iraq, the budget-busting Bush tax cuts of 2001 and 2003 and the Medicare prescription drug program because, after all, John Boehner, Mitch McConnell and the Republican majorities in Congress voted for all of it.

If today's Republican extortionists needed any more inspiration to back down from their blackmail scheme, their saint Ronald Reagan provided it in 1983:

"The full consequences of a default -- or even the serious prospect of default -- by the United States are impossible to predict and awesome to contemplate. Denigration of the full faith and credit of the United States would have substantial effects on the domestic financial markets and the value of the dollar."

Reagan knew what he was talking about. After all, the hemorrhage of red ink at the U.S. Treasury began on his watch.

As most analysts predicted, Reagan's massive $749 billion supply-side tax cuts in 1981 quickly produced even more massive annual budget deficits. Combined with his rapid increase in defense spending, Reagan delivered not the balanced budgets he promised, but record-setting debt. Forced to raise taxes eleven times to avert financial catastrophe, the Gipper nonetheless presided over a tripling of the American national debt to nearly $3 trillion. By the time he left office in 1989, Ronald Reagan signed a stunning 17 debt ceiling increases into law and more than equaled the entire debt burden produced by the previous 200 years of American history. It's no wonder the Gipper cited the skyrocketing deficits he bequeathed to America as his greatest regret.

And ours.

Sadly, thanks to a Republican deceit and a complicit media that portrays all issues as conflicts having two (and only two) sides, the truth may not set Americans free. In May, polls by CBS and Gallup showed that Americans by a 2-to-1 margin oppose raising the nation's $14.3 trillion debt ceiling. (Among Republicans, the gap was a staggering 70% to 8%.) Only now, thanks to the dire warnings of economists, think tanks, international financial bodies and even GOP-friendly business groups, the tide may be turning. A new Pew Research survey showed Americans now split as to whether raising the debt or defaulting on U.S. debt obligations is the greater concern.

Reality, as Stephen Colbert told President Bush to his face, may have "a well-known liberal bias," but for Republicans the supposed debate over the debt ceiling has never been about either reality or the truth. Instead, their objective, as Senate Minority Leader McConnell has boasted repeatedly, is to ensure President Obama is a one-term president.

But If the Republican hostage-takers succeed in blocking the debt ceiling increase required by August 2, all Americans will pay the price for the pathological lies of the GOP.

Starting August 3.

(For more background, see "10 Things the GOP Doesn't Want You to Know about the Debt.")