Ever since Kevin Drum invented it, centuries ago in blog years, Friday Cat Blogging has been a tradition in the reality-based community. So, here's a collection of Friday Felinity, in no particular order, they're all cute, dammit. (After giving image and the name of each cat, I've added a parenthetical that links to the cat's staffperson).

The Mighty Fang (Bad Tux, gold bug stomper).

Tomato and Mahler, and Abishek (kinda) on the laptop screen. (Independent Catholic, a priest for women's ordination).

Datsa (Pen-Elayne, fan and author).

Snowball (Mustang Bobby, Brooks eviscerator.)

Smithers (The Carpetbagger, hopefully a realist as opposed to a pessimist).

Zoey (MEC, at Mercury Rising).

Fluffo (Culture Ghost, historian and graphic polemicist)

.

Then, there's Oscar, who isn't anywhere near Mithras, fortunately.

Guest Bloggitty Goodness: Over at The Mighty Corrente Building, we don't do cats. Yet. Dogs, we have: Check out Chauncy, with Jane Goodall.

Classic blogging: The Man in the Grey Turtleneck calls his shot on Adjustable Rate Mortgages--back in 2004:

Has He Gone Insane?Has the entire country gone insane?

Now I'm starting to get a little scared. More than a little scared, actually. First we have this little tidbit about Alan Greenspan recommending that consumers replace their fixed rate mortages with variable rate ones.

Then I look around and discover that quite a few people have been getting variable rate mortgages.

This is really scary. A lot of people have been concerned about a bursting housing bubble happening once interest rates start to rise. Even if that happens it wouldn't necessarily be such a big deal. But, if a large chunk of our population got suckered into getting variable rate mortgages so they could go from buying a house the couldn't afford to buying a house they REALLY REALLY couldn't afford, the impact of an interest rate rise could be, uh, bad.

Here's the deal. Interest rates go up. Your housing price falls. Your mortgage payment goes up substantially. You can no longer afford to make your mortgage payment. And, since the market value of your house is now less than the value of your outstanding loan, you can't just sell and trade down. Default. Foreclosure. Cardboard box.

As long as most consumers have fixed rate loans, the consequences of increased interest rates and a sudden housing price downturn wouldn't necessarily be so great. But, if people are drinking Greenspan's kool-aid...

Serious!

(All images of cats are copyright by their respective owners.)

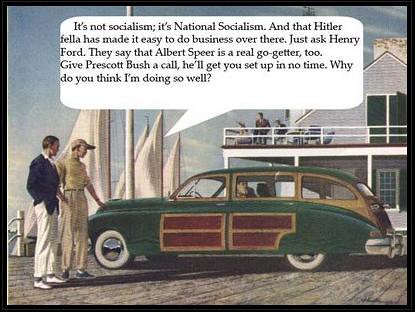

P.S. I can't resist linking to Culture Ghost one more time: